What is Competitive Price Threshold?

Amazon introduced a new data point called Competitive Price Threshold (CPT).

What is CPT and how did we get here?

Selling in 2014 every ASIN had a buy box. Eventually Amazon introduced the Fair Pricing Policy which was intended to protect consumers from what they considered price gouging. This in turn led to Suppressed Buy Boxes which acted as a tool to enforce the policy by functionally discouraging consumers from purchasing.

Competitive Price Threshold is the next step in this evolution. Amazon will mainly determine the CPT based off the prices on different marketplaces/retailers/sellers and or historical pricing data. For example, if something has been selling historically with a $50 buy box and it goes on sale somewhere at $30, the CPT may shift to around $30 and the buy box will be suppressed as a result until the price goes to $30 or below or the sale ends for extended period of time.

Where to see the CPT?

Keepa has the data point under Product Viewer with the column Competitive Price Threshold turned on.

How can I make use of the CPT datapoint?

The CPT represents the cut off point of when the buy box will turn back on or off. In theory this will translate to increasing velocity by lowering pricing or increasing margin by raising prices.

Suppressed Buy Boxes – When you have the CPT value, you can see how close or far away you are to turning the buy box back on. Example you’re at $52 and the CPT is at $50. The hope is, if you reduce your price by $2 the buy box turns back on and your tradeoff is lower margin for more velocity.

This will only be practical for ASINs where you’re very close to CPT value. There are times where you may be priced at $50 and the CPT is at $35, although this will most likely result in a loss it’s still useful to know that in the event you need to liquidate you can turn the buy box back on at $35.

Buy Boxes – This is useful to know if you’re priced UNDER the CPT as it represents an opportunity to raise your prices and increase margins while still maintaining the buy box. Example, you’re priced at $52 and the CPT is $55. This potentially means there’s $3 more of margin to be had if you’re the only seller on the listing.

Side note – From what I recall of buy box rotation, in general if you’re within +/- about 3-5% of the buy box you’ll still be in the rotation. For stealing the buy box from FBM sellers, I remember being able to price around 8% higher and be able to take and maintain the buy box.

Side note #2 – Certain Repricers will keep the CPT value in mind and factor that into their algorithm. I know Seller Snap does this in addition to business repricing which is separate from regular repricing.

Important notes:

Not all ASIN’s have CPT. As far as I can tell, these have no buy box ceiling. This is going to be useful on discontinued ASINs where the price increases as supply thins out. CPT will be your enemy by reducing velocity by suppressing the buy boxes (think retired Lego’s).

CPT appears to be a moving target. I liquidated an ASIN at $34.99 CPT when everyone was suppressed at around $45. Eventually after selling about 100 units, I noticed the CPT jumped up to $39.99 meaning an extra $5 margin. I’m not sure if it increased by $5 because I had revived the buy box OR because whatever sale caused the $34.99 CPT ended or a mixture of both.

What can I do now that I know about CPT?

This opens the possibility of sourcing suppressed ASIN’s with the intention of turning the buy box back on and benefiting from the increased velocity. Example – $14 suppressed profit versus $12 buy box profit. This also means you can avoid ASINs whose CPT is too aggressive and not likely to ever have the buy box.

Or it means you can source buy box ASIN’s with the hope of pricing slightly higher while still maintaining rotation. Example $10 profit matching buy box versus $12 profit being slightly higher.

Knowing the buy box ceiling means you can potentially set your repricer minimums a little higher.

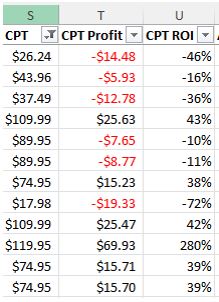

How do I use CPT? In general, I’m of the belief that ASINs with the buy box sell with less friction. Having the buy box rotate allows for the opportunity for extra profit whereas suppressed, everyone is competing for the lowest price and can lead to eroding margins. Factoring in CPT is just another addition to my toolkit and allows more flexibility. I now calculate CPT / CPT Profit / CPT ROI as part of my analysis. See the attachment as an example for Shop WSS.

Leave a Reply